cardinal health enterprise value

Historical Enterprise Value Data. Enterprise Value to Sales 011.

Cardinal Health shows a prevailing Real Value of 6256 per share.

. Our model approximates the value of Cardinal Health. Find out all the key statistics for Cardinal Health Inc. WaveMark Supply Management Workflow Solutions to help health systems improve outcomes through clinically integrated supply chain model DUBLIN Ohio Feb.

The company has an Enterprise Value to EBITDA ratio of 781. Stock CAH US14149Y1082. For Operating Data section.

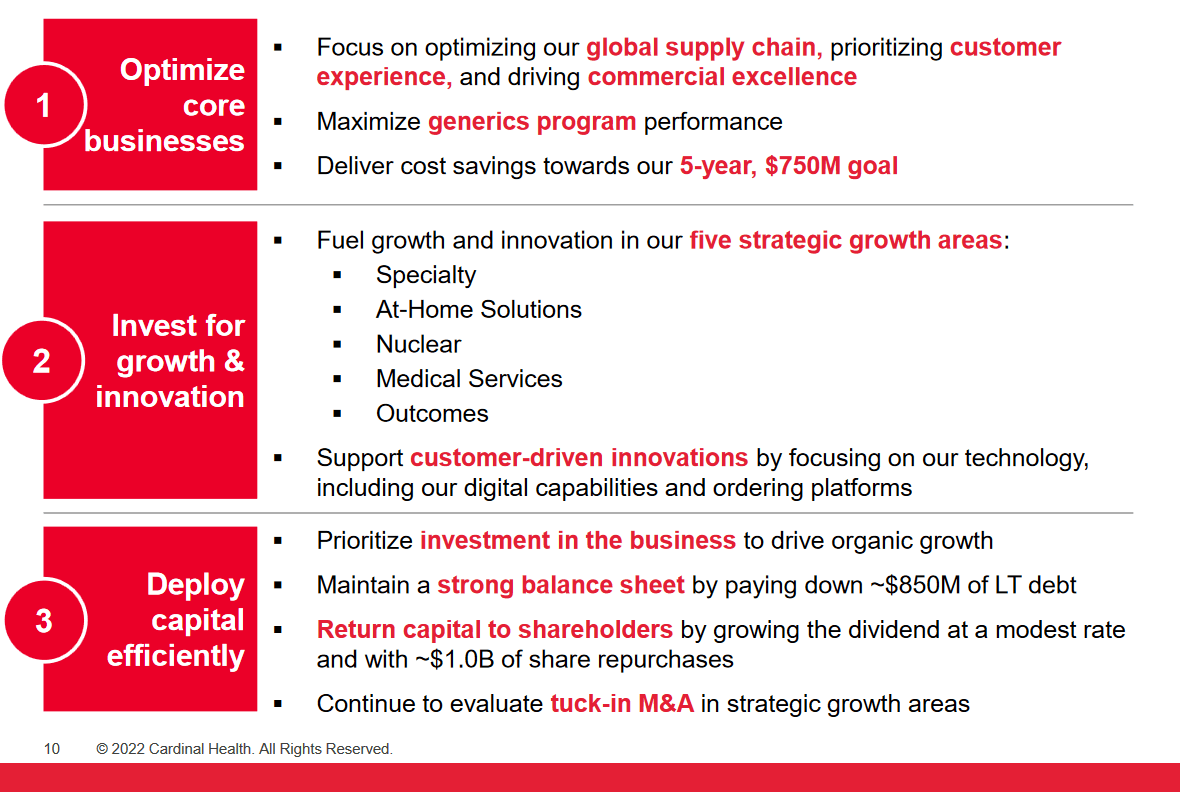

A where this ratio has been in the past. All numbers are indicated by the unit behind each term and all currency related amount. We aspire to be healthcares most trusted partner by building upon our scale and heritage in distribution products and solutions while driving growth in evolving areas of healthcare through customer insights data and analytics and focusing our resources on what matters most.

Per Share Data Cardinal Health Inc. CAH including valuation measures fiscal year financial statistics trading record share statistics and more. Furthermore the Zacks Rank 2 company flaunts a robust industry.

View and export this data back to 1994. 1839B for April 6 2022. The current price of the firm is 5621.

18 2021 PRNewswire -- To help. View and export this data back to 1985. The current Enterprise Value is estimated to increase to about 247 B while Free Cash Flow is projected to decrease to roughly 23 B.

Cardinal Health CAH Q3 Earnings Lag Estimates Revenues Top 050522-944AM EST Zacks. 26 rows Cardinal Health Enterprise Value. CAH 5487 -096-172 Will CAH be a Portfolio Killer in May.

1898B Henry Schein Inc. Enterprise Value Range Past 5 Years. Specialty and global logistics businesses and continue to expand it across the enterprise.

Enterprise Value to EBITDA 726. Cardinal Healths Revenue for the trailing twelve months TTM ended in Mar. Which include finished goods commercialized under a vendor brand or the Cardinal Health brand andor as.

All numbers are indicated by the unit behind each term and all currency related amount. Cardinal Healths Revenue for the trailing twelve months TTM ended in Mar. Cardinal Health is an inspired choice for value investors as it is hard to beat its incredible lineup of statistics on this front.

What we value We aspire to be healthcares most trusted partner by building upon our scale and heritage in distribution products. The best use of the PE ratio is to compare the stocks current PE ratio with. 5152B for May 27 2022.

2022 Cardinal Health Inc. Earnings Per Share 208. In fact the 167B TTM sales that CAH generated is yet.

For Operating Data section. This statistic displays the total enterprise value of leading medical surgical or dental supply companies in the United States as of April 30 2021. Global Procurement is responsible for creating and managing diverse strategic supplier partnerships that drive enterprise value with innovation best cost and competitive advantages that benefit customers suppliers and patients.

The Enterprise value factors in Market capitalization cash debt and other assets and liabilities. At this time the firm appears to be undervalued. 1324B Owens Minor Inc.

2022 adds up the quarterly data reported by the company within the most recent 12 months which was 176847 Mil. The Director Enterprise Architecture drives value to Cardinal Health through their leadership experience broad data knowledge thought leadership and ability to establish and execute a strategy. At this time Cardinal Health.

Forcasts revenue earnings analysts expectations ratios for CARDINAL HEALTH INC. B how it compares to. Historical Enterprise Value Data.

Cardinal Healths current Enterprise Value is 18103 Mil. Currently Cardinal Health Incs price-earnings ratio is 304. McKesson Enterprise Value.

As of April 29 2022 Cardinal Health Inc had a 166 billion market capitalization compared to the Retailers - Drug median of 400 million Cardinal Health Incs stock is up 127 in 2022 down 57 in the previous five trading days and down 38 in the past year. This role covers both the information and integration domains and will face off to a variety of stakeholders including the chief architects for the. Cardinal Health Inc key financial stats and ratios.

All values updated annually at fiscal year end. Cardinal Healths current Enterprise Value is 18975 Mil. 4 5 Cardinal Health FY21 Corporate Citizenship Report Diversity equity and inclusion Our customers and partners.

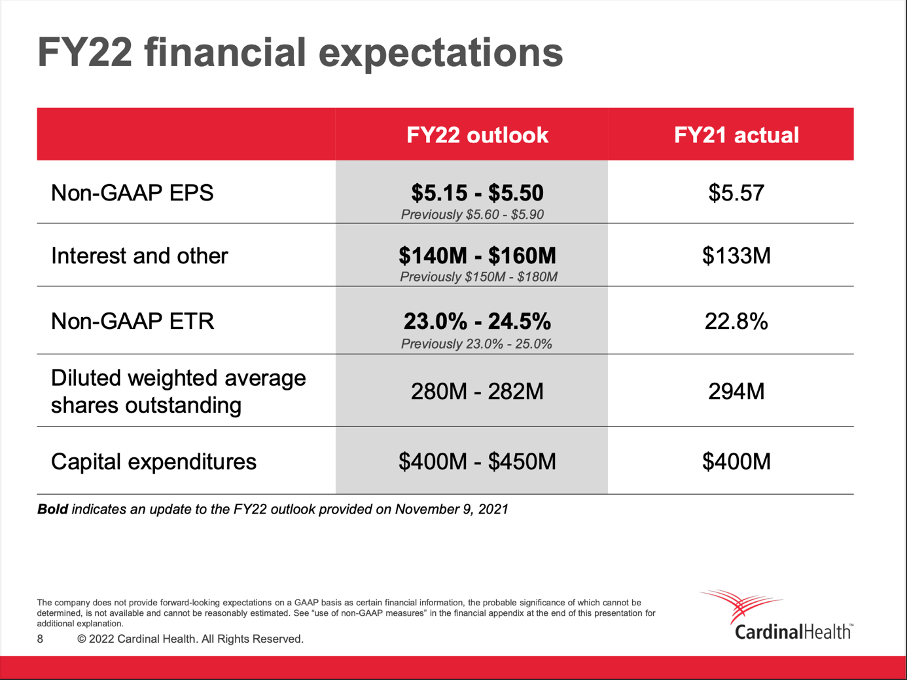

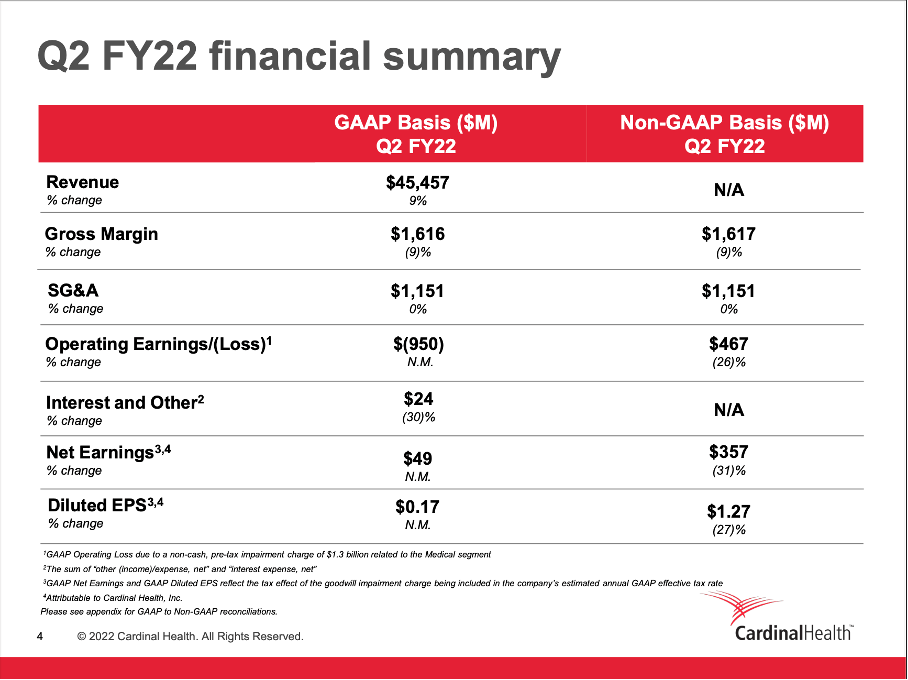

Cardinal Health is seeing encouraging top-line growth with 13 YoY revenue growth in Q122 ended September 2021 to 440 billion. As of 2021 they employed 4730k people. 1612B Minimum Dec 01 2021.

Find the latest Price Book Value for Cardinal Health CAH. Is a healthcare services and products company which engages in the provision of customized solutions for hospitals healthcare. CAH price-to-sales ratio is 010.

2022 adds up the quarterly data reported by the company within the most recent 12 months which was 176847 Mil. All rights reserved Legal Terms of Use.

Cardinal Health Counter Talk Podcast

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

Insurance Flyer Templates Free Never Underestimate The Influence Of Insurance Flyer Template Flyer Template Flyer Design Flyer

Pin On 55 Must See Ncpa Annual Convention 2018 Exhibits Booths Boston Ma

Cardinal Health Stable And On The Road To Recovery Nyse Cah Seeking Alpha

Cardinal Health Crunchbase Company Profile Funding

Who We Are Fuse By Cardinal Health

Wba Expands Partnership With Microsoft And Adobe Https Www Chaindrugreview Com Wba Creates N Healthcare Technology Enterprise Architecture Microsoft Dynamics

Harvard Business Harvardhbs Harvard Business School Business Management Degree Business Management

Cardinal Health Evp Explains How Diversity Equity And Inclusion Can Produce Chemical Reactions That Unleash Amazing Innovations

Carrefour Business Model Canvas Business Model Canvas Business Model Canvas Examples Business Canvas

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

The Fragmentation Of Health Data Health Care Data Healthcare System

Continuous Improvement Is Good But Is It Lean Lean Enterprise Lean Six Sigma Change Management